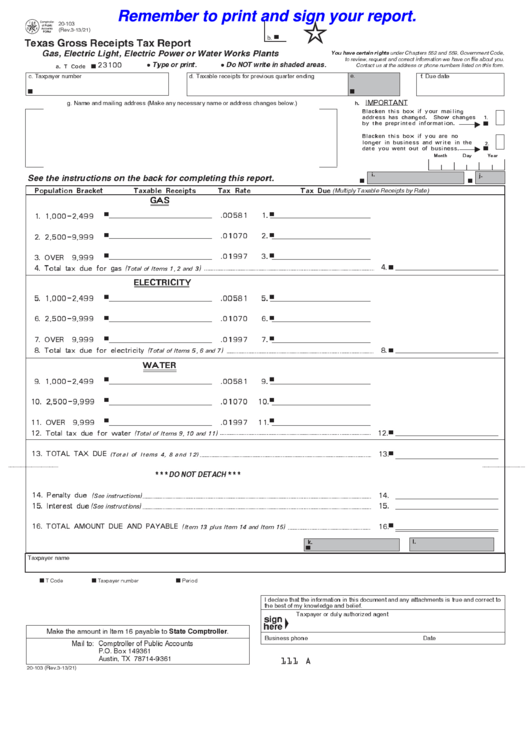

It is no longer necessary to estimate the gross receipts. See the illustration below for the calculation of the tax. This represents a significant increase from the 5 million threshold under prior. The gross receipts for the third year are based on the ACTUAL gross receipts for the entire second year. 448 by redefining a small business as a corporation or partnership with average annual gross receipts for the prior three - year period (ending with the tax year that precedes the current tax year) that do not exceed 25 million (Sec. Although the Gross Receipts Tax is imposed on businesses.

#CALCULATE GROSS RECEIPTS LICENSE#

Calculating the Business License for the Third Year Gross receipts are the total amount of money or other consideration received from the above activities. This adjustment will be included in the tax for the Third Year. After the close of the year, the estimate must be adjusted to reflect the actual gross receipts received.

The gross receipts for the second year are an estimate of the revenue that the business will earn for an entire year. Calculating the Business License for the Second Year This adjustment will be included in the tax for the Second Year. The gross receipts are an estimate of the revenue that will be earned by the business until December 31 of the year in which the business opens. Calculating the Business License for the First Year If the actual gross receipts at the end of the year are. Licenses are obtained at the beginning of each year. First Year (partial of operation) - A business makes an initial gross receipt estimate of 160,000. Renewal applications must be filed by March 1 and payments made by March 15. Employers may also elect to use an alternative quarter to calculate gross receipts. Business license renewals will be sent out each year. Employers may generally qualify for the ERC if their gross receipts for a calendar quarter in 2021 are less than 80 percent of the gross receipts (>20 percent decline) for the same calendar quarter in calendar year 2019.

An estimate of the gross revenue you expect the business to earn until December 31 of the year the business will open.When you call, please have these items ready: Once this approval is obtained, a Business License Application (PDF) must be completed and submitted to the Office of the Commissioner of the Revenue. Zoning approval (PDF) is required before a business license may be issued. Each business operating in the City of Fredericksburg is required to obtain a business license.

0 kommentar(er)

0 kommentar(er)